Global Real Estate

GlobalREIT - Global Real Estate Investment Trust

Greetings of Peace of the Universe

What is Global Reit?

Global REIT is to create a global real estate investment portfolio that will offer additional benefits than a traditional REIT by intertwining REITs to the Block Chain Technology.

ICO Alert Quick Facts

Blockchain based REIT

Contributors will receive both GREM and GRET tokens

$0.70 USD = 1 GREM token

$1 USD = 1 GRET token

GREM and GRET Pre-ICO: May 1, 2018-May 31, 2018

GREM and GRET Public ICO: June 1, 2018-June 31, 2018

GREM 79,285,714 available / 200,000,000 total supply

GRET 16,650,000 available / 75,000,000 total supply

First asset under management is a $75M hotel scheduled for Q4 2018

Participants of the token sale will receive GRET and GREM tokens in June 2018.

Allocation

RoadMap

- June 2018: intended acquisition of the first assets (hotels)

- July 2018: payment of the first dividends

- August 2018: intended acquisition of the second pool of assets (residential buildings)

- October 2018: intended acquisition of the third pool of assets (shopping centers)

- December 2018: intended acquisition of the fourth pool of assets (hotels)

Summary: The project presented a strategy for the formation of an asset portfolio. The strategy is based on the following diversification: different types of assets (hotels, shopping centers, residential areas, etc.) in different countries.

Team

#Crypto

#Blockchain

#GlobalREIT

#BlockchainBasedREIT

#ethereum

#bitcoin

#cryptocurrency

#btc

More Information Visit The GlobalREIT Link:

WEBSITE : http://www.globalreit.io/

ANN THREAD : https://bitcointalk.org/index.php?topic=3341986.msg34966361#msg34966361

WHITEPAPER : https://globalreit.io/front/whitepaper/Global-REIT.pdf

FACEBOOK : https://www.facebook.com/GlobalReit-144007413076936/

TWITTER : https://twitter.com/GlobalReit01

TELEGRAM : https://t.me/GlobalReit

BOUNTY TELEGRAM : https://t.me/GlobalREIT_Bounty

My Bitcointalk Profile : Sesepuh

Eth Address : 0xE6918D7ec07F35bdc579034692aAC61881Aff3D8

Greetings of Peace of the Universe

What is Global Reit?

Global REIT is to create a global real estate investment portfolio that will offer additional benefits than a traditional REIT by intertwining REITs to the Block Chain Technology.

ICO Alert Quick Facts

Blockchain based REIT

Contributors will receive both GREM and GRET tokens

$0.70 USD = 1 GREM token

$1 USD = 1 GRET token

GREM and GRET Pre-ICO: May 1, 2018-May 31, 2018

GREM and GRET Public ICO: June 1, 2018-June 31, 2018

GREM 79,285,714 available / 200,000,000 total supply

GRET 16,650,000 available / 75,000,000 total supply

First asset under management is a $75M hotel scheduled for Q4 2018

For those who are not familiar with Global REIT, can you explain what it is and what the team aims to accomplish?

Global REIT is the first ever Blockchain based Sharia-compliant REIT to be launched in the market.

It is offering investors exposure to global real estate markets without the necessity of acquiring an entire property and shift the management and compliance obligations to the fund management.

Global REIT will acquire assets starting from U.A.E. and rapidly enter properties in jurisdictions worldwide. The first Asset under Management (AUM) will start with Net Asset Value (NAV) of USD $75 million and the total portfolio value of Global REIT is projected grow significantly over the next few years.

The ICO of Global REIT will offer dual utility tokens to its subscribers:

Global REIT Asset Token (GRET): The GRET token will pay monthly dividends to the subscribers.

Global REIT Fund Manager Token (GREM): The GREM token will offer capital growth as the fund asset base increases.

How does Global REIT function within the platform and why is it needed?

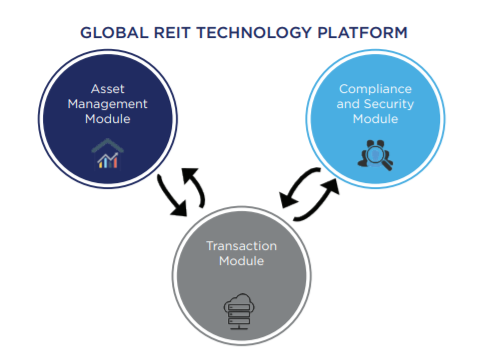

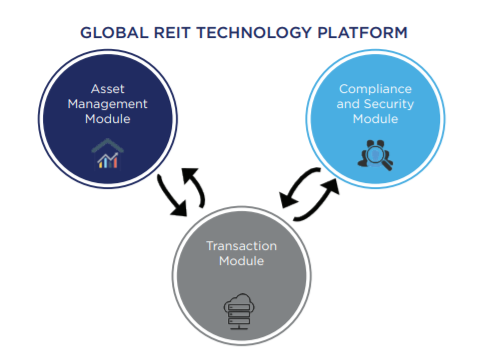

The platform is built on blockchain. Global REIT includes the following components:

- Asset management module

- Compliance and security module

- Transaction module

Technical Description

The platform components work as follows:

- Asset management module. This module allows investors to view the list of assets listed on the platform with all the details, such as exchange rates, NAV, dividends, holding intervals and minimum investment and also see general information on the market.

- Transaction module. The transaction module handles all API calls and checks all transactions

- Compliance and security module. The module serves to provide a 24/7 security level by implementing thorough industry standard checks and balances for parties involved in transactions, ensuring that fraud is eliminated in the system. In addition to integrating third-party vendors with KYC and AML providers, the system implements security measures and military-level protocols to ensure system reliability.

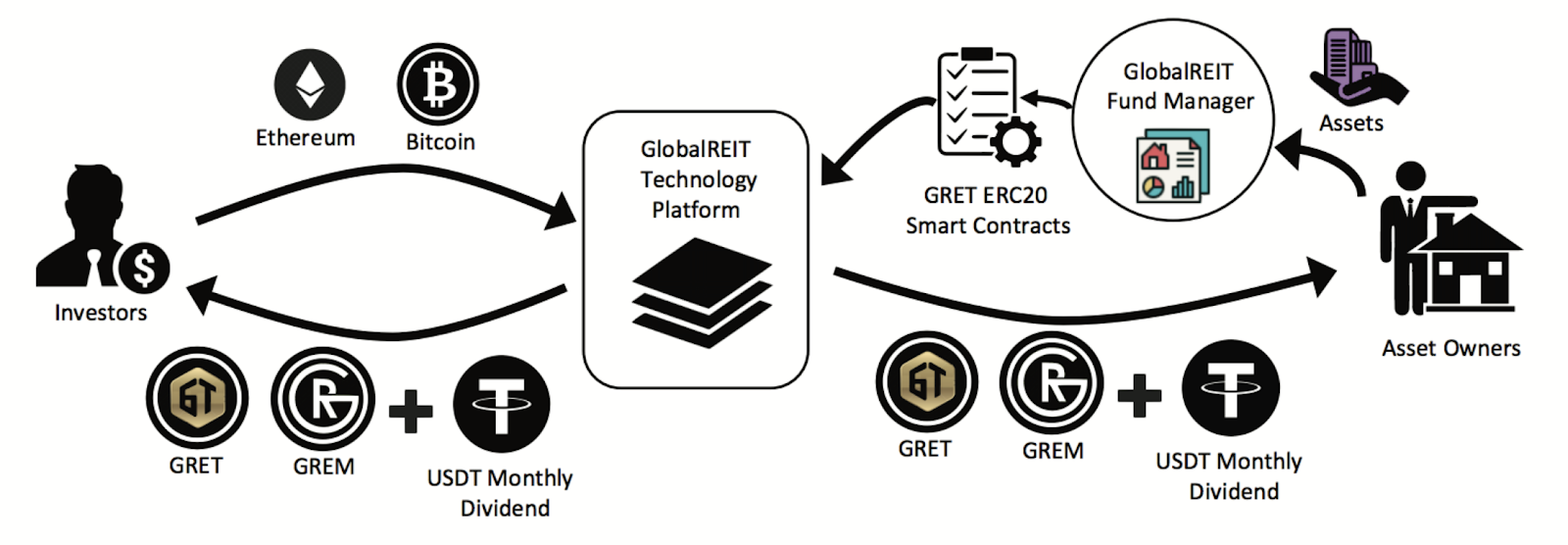

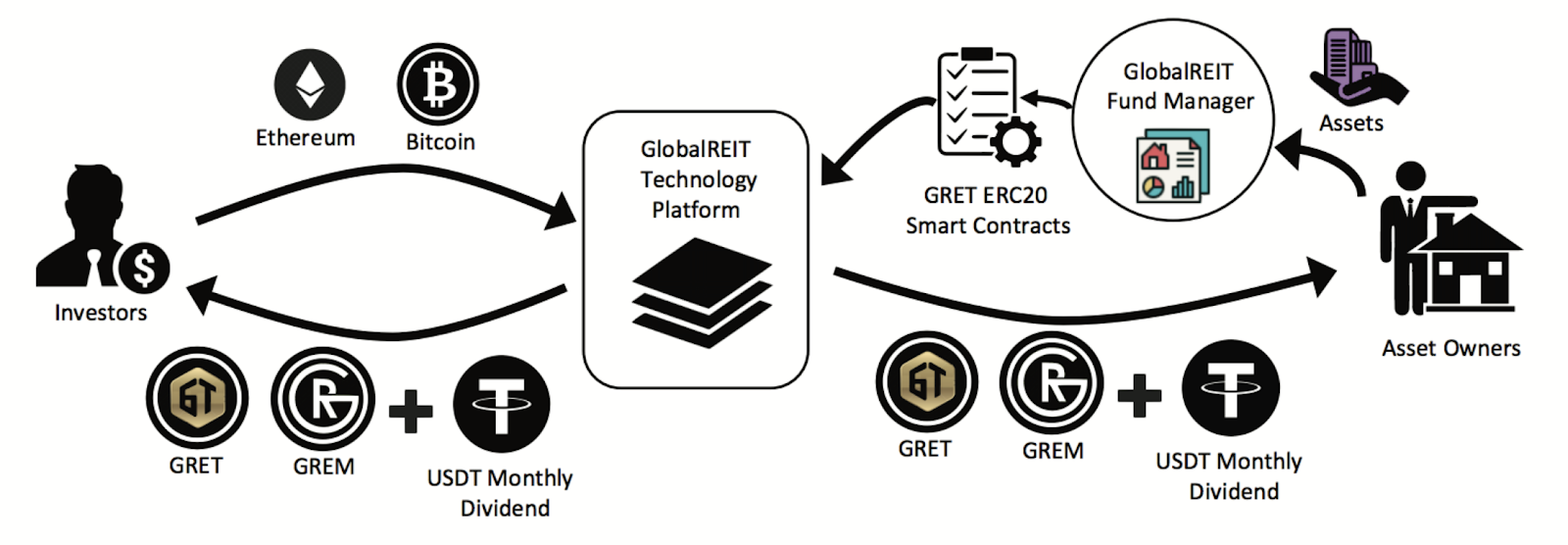

The ecosystem of the platform includes the following participants: investors, owners of assets (real estate) and the Global REIT managing company. Interaction between the participants is as follows:

1) The investor invests cryptocurrency (BTC, ETH) in the fund

2) The asset owner or broker registers its assets in the database with the help of Global REIT management company

3) Global REIT confirms receipt of funds from the investor in a notarized form

4) The funds are transferred to the asset owner

5) The investor receives tokens and becomes the co-owner of the asset

The project uses existing technologies that have proven themselves in the market.

You say that you are different than “traditional” REITS. What benefits does Global REIT provide that other REITs don’t?

Global REIT will work on the same mechanism as a traditional REIT, but will offer additional benefits including:

Future access to all its Assets under Management (AUM) starting with free stays every year in its first Hospitality Asset

Reward points will be offered in the Loyalty Programs attached with its AUM. These points can be used to avail free services up to a certain limit

The Asset portfolio of Global REIT will include assets acquired globally, unlike traditional REITs which has imposed restrictions in this aspect

Token holders of Global REIT will benefit from their participation as they will get two tokens; the GREM token will offer part of Fund Management Income as well which is not offered by traditional REITs

Token holders of the “Asset Owning Company” will be paid dividends monthly unlike traditional REITs

The barrier for entry in real estate investment is high. How can Global REIT make investing in real estate more accessible?

Through blockchain, the token holders can invest in small amounts which gets pooled to acquire larger assets.

There are other blockchain-based real estate investment platforms in the works. How is yours different? If there are other competitors, how do you intend on keeping users?

Currently other platforms are focusing on tokenizing. We are focusing to offer monthly returns in the form of dividends which is unique to other competitors. Going forward we will add more utility for the token holders at assets under management.

You say that you are the first blockchain based REIT that is compliant in Sharia Law. Why is that important and how does it affect your platform?

Global REIT is the first ever blockchain based Shariah-compliant REIT to be launched in the market.

It is offering investors exposure to global real estate markets without the necessity of acquiring an entire property and shift the management and compliance obligations to the fund management. In the Middle East, a large percentage of investors would like the income to be Shariah-compliant. Hence, we have ensured this requirement.

Global REIT is a new kind of REIT that relies on an entirely new infrastructure. What effect will Global REIT have on the industry as a whole?

Global REIT is to create a global real estate investment platform that will offer additional benefits than a traditional REIT by intertwining REITs with the blockchain technology.

Global REIT will begin its investor offering at its home base in Dubai, U.A.E. and then rapidly expand worldwide. The company sees cryptocurrency investors who want to simultaneously invest in real estate and earn regular dividends and, real estate holders seeking to exit into a liquid market anchored by cryptocurrency, as their key targets for participation on the Global REIT platform. The ease of being built in blockchain allows instant distribution which is destined to revolutionize the REIT industry

Investing in REITs offers an alternative to buying real estate directly. A successful REIT depends primarily on the management team choosing the right properties based on current market trends. As such, how does a global REIT’s team meet the demands of successfully navigating the REIT market?

The Global REIT teams brings extensive experience in real estate. Moreover, there will be a global team of directors appointed for acquisitions in each region which lead the selection of assets in their respective regions.

As a non-Global REIT question, we like to ask for unique predictions for the ICO and cryptocurrency space in the future. Where do you see both in the next 3–5 years?

The ICO space is at beginning of a very long road, early adopters have only really started benefiting from the new era in fundraising. We foresee that blockchain-based currencies will become adopted by all online users world wide.

Pre-ICO Information

Contributors will receive both Global REIT (GREM) and (GRET) tokens, which are two different utilities.

Global REIT (GREM) Token:

The Pre-ICO for (GREM) will begin on May 1, 2018 and will end on May 31, 2018. There are a total of 57,857,143 (GREM) tokens with a total supply of 200,000,000 available during the Pre-ICO, representing 28% of the total Global REIT (GREM) supply. A soft cap of 1,250,000 is set for this period.

The main ICO for Global REIT (GREM) tokens will begin on June 1, 2018 and will end on June 30, 2018. There are a total of 21,428,000 (GREM) tokens with a total supply of 200,000,000 available during the main sale, representing 10% of the total (GREM) supply. A hard cap of 5,000,000 is set for this period.

$0.70 USD = 1 GREM Token

$1 USD = 1 GRET Token

Tokens can be purchased with USD fiat, Bitcoin, or ETH.

Global REIT is an ERC20 token, so it’s important that contributors use ERC20 compatible wallets to send funds to the ICO smart contract, and to receive the Global REIT tokens.

Restrictions

Citizens of US, Canada & Australia cannot participate in the token sale.

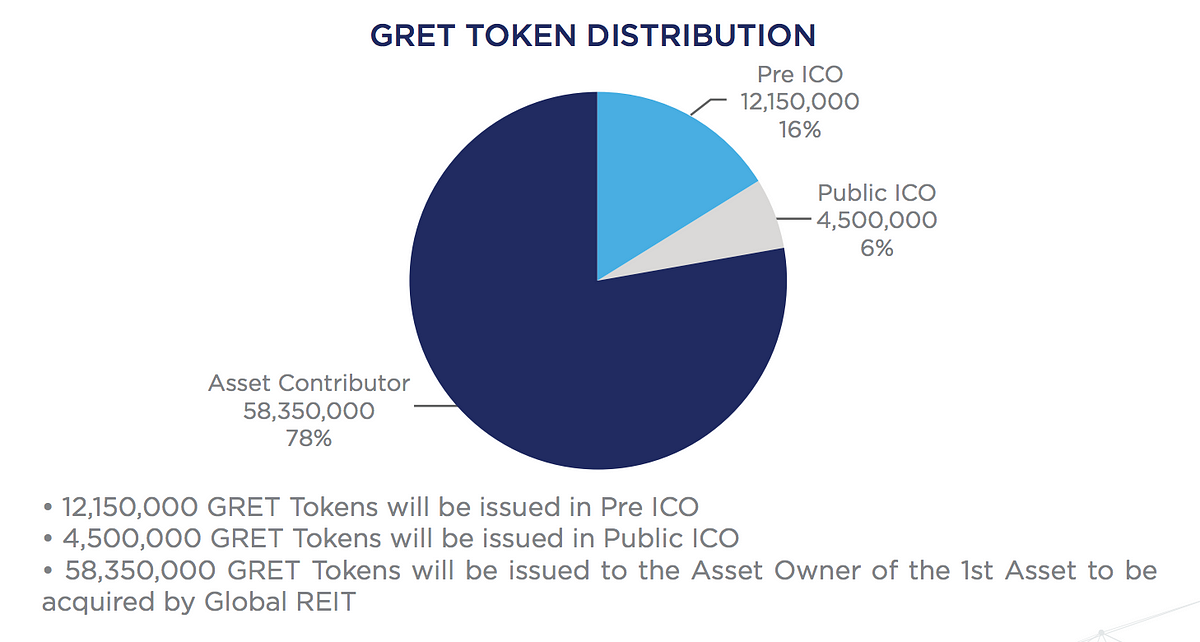

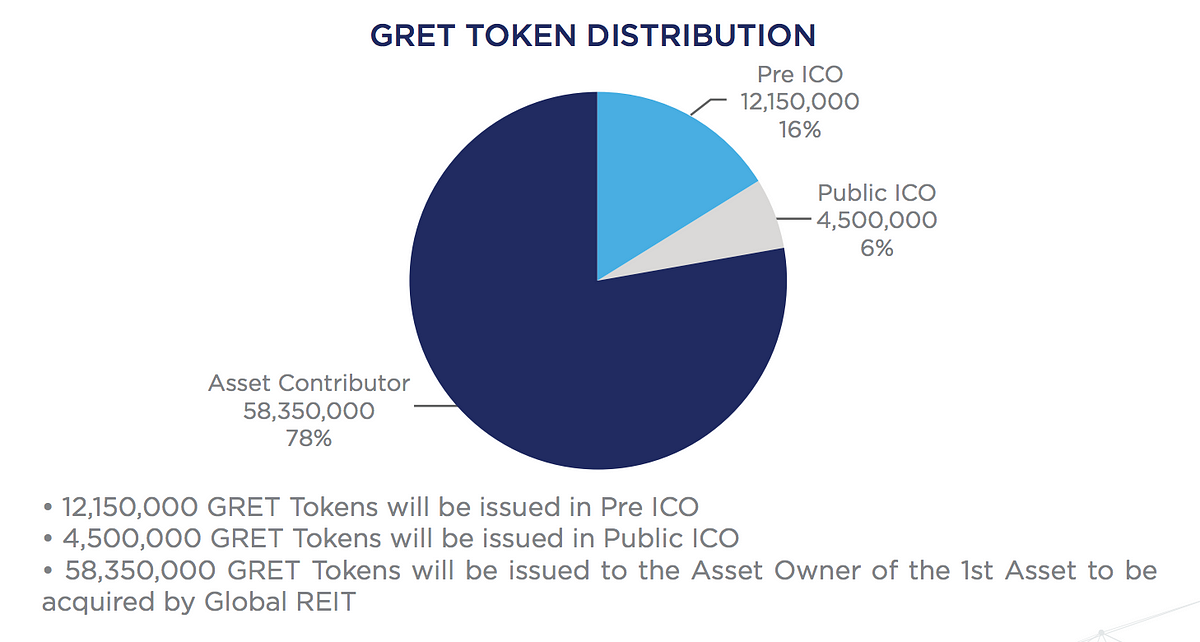

Token Distribution Information

Global REIT is the first ever Blockchain based Sharia-compliant REIT to be launched in the market.

It is offering investors exposure to global real estate markets without the necessity of acquiring an entire property and shift the management and compliance obligations to the fund management.

Global REIT will acquire assets starting from U.A.E. and rapidly enter properties in jurisdictions worldwide. The first Asset under Management (AUM) will start with Net Asset Value (NAV) of USD $75 million and the total portfolio value of Global REIT is projected grow significantly over the next few years.

The ICO of Global REIT will offer dual utility tokens to its subscribers:

Global REIT Asset Token (GRET): The GRET token will pay monthly dividends to the subscribers.

Global REIT Fund Manager Token (GREM): The GREM token will offer capital growth as the fund asset base increases.

How does Global REIT function within the platform and why is it needed?

The platform is built on blockchain. Global REIT includes the following components:

- Asset management module

- Compliance and security module

- Transaction module

Technical Description

The platform components work as follows:

- Asset management module. This module allows investors to view the list of assets listed on the platform with all the details, such as exchange rates, NAV, dividends, holding intervals and minimum investment and also see general information on the market.

- Transaction module. The transaction module handles all API calls and checks all transactions

- Compliance and security module. The module serves to provide a 24/7 security level by implementing thorough industry standard checks and balances for parties involved in transactions, ensuring that fraud is eliminated in the system. In addition to integrating third-party vendors with KYC and AML providers, the system implements security measures and military-level protocols to ensure system reliability.

The ecosystem of the platform includes the following participants: investors, owners of assets (real estate) and the Global REIT managing company. Interaction between the participants is as follows:

1) The investor invests cryptocurrency (BTC, ETH) in the fund

2) The asset owner or broker registers its assets in the database with the help of Global REIT management company

3) Global REIT confirms receipt of funds from the investor in a notarized form

4) The funds are transferred to the asset owner

5) The investor receives tokens and becomes the co-owner of the asset

The project uses existing technologies that have proven themselves in the market.

You say that you are different than “traditional” REITS. What benefits does Global REIT provide that other REITs don’t?

Global REIT will work on the same mechanism as a traditional REIT, but will offer additional benefits including:

Future access to all its Assets under Management (AUM) starting with free stays every year in its first Hospitality Asset

Reward points will be offered in the Loyalty Programs attached with its AUM. These points can be used to avail free services up to a certain limit

The Asset portfolio of Global REIT will include assets acquired globally, unlike traditional REITs which has imposed restrictions in this aspect

Token holders of Global REIT will benefit from their participation as they will get two tokens; the GREM token will offer part of Fund Management Income as well which is not offered by traditional REITs

Token holders of the “Asset Owning Company” will be paid dividends monthly unlike traditional REITs

The barrier for entry in real estate investment is high. How can Global REIT make investing in real estate more accessible?

Through blockchain, the token holders can invest in small amounts which gets pooled to acquire larger assets.

There are other blockchain-based real estate investment platforms in the works. How is yours different? If there are other competitors, how do you intend on keeping users?

Currently other platforms are focusing on tokenizing. We are focusing to offer monthly returns in the form of dividends which is unique to other competitors. Going forward we will add more utility for the token holders at assets under management.

You say that you are the first blockchain based REIT that is compliant in Sharia Law. Why is that important and how does it affect your platform?

Global REIT is the first ever blockchain based Shariah-compliant REIT to be launched in the market.

It is offering investors exposure to global real estate markets without the necessity of acquiring an entire property and shift the management and compliance obligations to the fund management. In the Middle East, a large percentage of investors would like the income to be Shariah-compliant. Hence, we have ensured this requirement.

Global REIT is a new kind of REIT that relies on an entirely new infrastructure. What effect will Global REIT have on the industry as a whole?

Global REIT is to create a global real estate investment platform that will offer additional benefits than a traditional REIT by intertwining REITs with the blockchain technology.

Global REIT will begin its investor offering at its home base in Dubai, U.A.E. and then rapidly expand worldwide. The company sees cryptocurrency investors who want to simultaneously invest in real estate and earn regular dividends and, real estate holders seeking to exit into a liquid market anchored by cryptocurrency, as their key targets for participation on the Global REIT platform. The ease of being built in blockchain allows instant distribution which is destined to revolutionize the REIT industry

Investing in REITs offers an alternative to buying real estate directly. A successful REIT depends primarily on the management team choosing the right properties based on current market trends. As such, how does a global REIT’s team meet the demands of successfully navigating the REIT market?

The Global REIT teams brings extensive experience in real estate. Moreover, there will be a global team of directors appointed for acquisitions in each region which lead the selection of assets in their respective regions.

As a non-Global REIT question, we like to ask for unique predictions for the ICO and cryptocurrency space in the future. Where do you see both in the next 3–5 years?

The ICO space is at beginning of a very long road, early adopters have only really started benefiting from the new era in fundraising. We foresee that blockchain-based currencies will become adopted by all online users world wide.

Pre-ICO Information

Contributors will receive both Global REIT (GREM) and (GRET) tokens, which are two different utilities.

Global REIT (GREM) Token:

The Pre-ICO for (GREM) will begin on May 1, 2018 and will end on May 31, 2018. There are a total of 57,857,143 (GREM) tokens with a total supply of 200,000,000 available during the Pre-ICO, representing 28% of the total Global REIT (GREM) supply. A soft cap of 1,250,000 is set for this period.

The main ICO for Global REIT (GREM) tokens will begin on June 1, 2018 and will end on June 30, 2018. There are a total of 21,428,000 (GREM) tokens with a total supply of 200,000,000 available during the main sale, representing 10% of the total (GREM) supply. A hard cap of 5,000,000 is set for this period.

$0.70 USD = 1 GREM Token

$1 USD = 1 GRET Token

Tokens can be purchased with USD fiat, Bitcoin, or ETH.

Global REIT is an ERC20 token, so it’s important that contributors use ERC20 compatible wallets to send funds to the ICO smart contract, and to receive the Global REIT tokens.

Restrictions

Citizens of US, Canada & Australia cannot participate in the token sale.

Token Distribution Information

Participants of the token sale will receive GRET and GREM tokens in June 2018.

Allocation

RoadMap

- June 2018: intended acquisition of the first assets (hotels)

- July 2018: payment of the first dividends

- August 2018: intended acquisition of the second pool of assets (residential buildings)

- October 2018: intended acquisition of the third pool of assets (shopping centers)

- December 2018: intended acquisition of the fourth pool of assets (hotels)

Summary: The project presented a strategy for the formation of an asset portfolio. The strategy is based on the following diversification: different types of assets (hotels, shopping centers, residential areas, etc.) in different countries.

Team

#Crypto

#Blockchain

#GlobalREIT

#BlockchainBasedREIT

#ethereum

#bitcoin

#cryptocurrency

#btc

More Information Visit The GlobalREIT Link:

WEBSITE : http://www.globalreit.io/

ANN THREAD : https://bitcointalk.org/index.php?topic=3341986.msg34966361#msg34966361

WHITEPAPER : https://globalreit.io/front/whitepaper/Global-REIT.pdf

FACEBOOK : https://www.facebook.com/GlobalReit-144007413076936/

TWITTER : https://twitter.com/GlobalReit01

TELEGRAM : https://t.me/GlobalReit

BOUNTY TELEGRAM : https://t.me/GlobalREIT_Bounty

My Bitcointalk Profile : Sesepuh

Eth Address : 0xE6918D7ec07F35bdc579034692aAC61881Aff3D8

NB: Dear Readers, if this article was interesting and useful for you,

put Upvote and followed my blog.

And I wait for your comments,

what do you think about this project?

thanks.

Komentar

Posting Komentar